A year ago, the top 10 global players were collectively worth about $9 trillion. Today, the 10 most valuable tech companies in the world are worth about $12 trillion, a remarkable figure considering what's par for the course in the big leagues today – a 13-figure valuation – was literally unprecedented just three years ago. Here's a look at the most valuable tech stocks on earth and how each company is raking in gobs of money.

10)ASML Holding NV (ticker: ASML)

Market value: $350 billion

The Netherlands-based ASML is new to the list of the 10 largest tech companies, the beneficiary of a 140% rally over the last year. Lest you think such a meteoric rise in ASML stock makes it a fluke among top tech companies, think again. ASML essentially operates a legal monopoly as the world's only high-quality extreme ultraviolet lithography machine-maker. In English: ASML makes the machines that etch circuit designs onto the world's most advanced, smallest semiconductors, making it an absolutely vital part of the global supply chain from which chipmakers, during a global chip shortage, are forced to buy if they don't want to lose ground to peers. Some of those chipmakers are on this list. Last quarter, ASML revenue rose 20.9% and earnings per share rose 40.8%. The company announced a 9 billion-euro buyback program and expects sales growth of around 35% for the full year.

9)Samsung Electronics Co. Ltd. (005930.KS)

Market value: $440 billion

Samsung earned its spot among the top 10 most valuable tech companies in the world by going head-to-head against one of the most imposing companies on earth: Apple. Samsung's line of Galaxy smartphones and tablets is the biggest direct competitor to the iPhone and iPad, and the South Korean company has helped whittle Apple's lead in tablet market share from 54 percentage points in 2011 (61% to 7%) to just 12 percentage points a decade later (31% to 19%). And Samsung is still the global market leader in smartphone market share, with 18% of the market to Apple's 15%. It doesn't have the services revenue that Apple does, but its strong brand, scale, and staying power in other areas like TVs and appliances makes it a well-rounded and formidable global tech player.

8)Nvidia Corp. (NVDA)

Market value: $525 billion

High-tech chipmaker Nvidia has had a remarkable run to earn its spot as one of the 10 most valuable tech companies on earth. Up more than 1,200% in the last five years, NVDA stock has benefited from the company's enviable positioning in the fast-growing graphics processing unit, or GPU, market. GPUs and their associated software are used in everything from gaming to data centers to professional visualization to the automotive market. Nvidia's products are crucial for rapidly growing industries such as self-driving cars and artificial intelligence, and the company is aiming to seize market share from Intel Corp. (INTC) in the data center central processing unit market when it releases its Grace CPU in 2023 – a chip Nvidia has claimed is 10 times faster than today's fastest servers.

7)Tencent Holdings Ltd. (TCEHY)

Market value: $550 billion

Tencent is the most valuable tech company in China, with a dizzying array of business units that includes WeChat, a social media and payments platform with over 1.25 billion monthly active users; fintech businesses; online advertising; and a dominant gaming division that by itself is up there with Sony Group Corp. (SONY) as the world's top gaming company by revenue. China's recent crackdown on private industry has shaved more than 40% from Tencent's valuation since February, when the tech company was worth about $1 trillion. China's heavy regulatory hand is the only major obstacle to reaching that level again. Even during the most challenging regulatory environment in years, Tencent was able to grow revenue 23% last quarter.

6)Taiwan Semiconductor Manufacturing Co. Ltd. (TSM)

Market value: $595 billion

This company, colloquially referred to as TSMC, is the single largest semiconductor foundry in the world. Foundries do the dirty work of assembling the high-tech chips found in everything from smartphones and computers to automobiles and airplanes. TSMC has been in this game for a long time. And since the company went public in 1994, revenue has posted a compound annual growth rate of 17.2%. With 57% global market share in the foundry business, many of the world's biggest tech companies are loyal customers, including Apple and Nvidia. With a strong track record, a robust balance sheet earning it the industry's highest credit rating, economies of scale and strong long-term relationships with massive clients, the Taiwan-based TSMC seems unlikely to leave the top 10 anytime soon.

5)Facebook Inc. (FB)

Market value: $1 trillion

FB stock has benefited greatly this year from the economic recovery. In less than nine months, the stock is up more than 30%, allowing the social media giant to crack the $1 trillion mark for the first time. Advertisers are more willing to spend than they were a year ago, with year-over-year revenue jumping 56% in the second quarter. There are more than 3.5 billion monthly active users across its family of apps, which include Instagram, WhatsApp and Messenger in addition to the eponymous Facebook app. While constantly making enemies on Capitol Hill due to privacy issues, misinformation and, more recently, problems relating to the mental health of Instagram users, Facebook still has ample room to grow. Facebook Marketplace and an increased focus on shopping features on Instagram offer promising growth in e-commerce, while Facebook's vision for virtual reality and a "metaverse" also has some really attractive long-term upside.

4)Amazon.com Inc. (AMZN)

Market value: $1.7 trillion

Amazon might be considered primarily a retailer by some, but at its heart, it's a tech company. Not only does the company crank out a dizzying array of tech gadgets, ranging from the Alexa line of smart speakers to its Kindle tablets, but Amazon's cloud computing arm, Amazon Web Services, or AWS, is a powerhouse and the leading provider in the U.S. Although AWS accounted for just 13.1% of overall revenue last quarter, it was responsible for 54.4% of the company's operating income. It's the kind of growth engine that allowed Amazon to operate at a loss internationally until very recently, and is a cash cow in no danger of being disrupted.

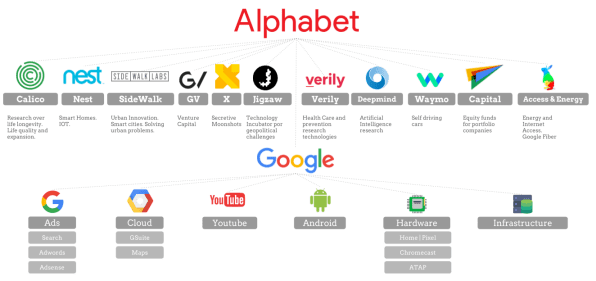

3)Alphabet Inc. (GOOG, GOOGL)

Market value: $1.85 trillion

Do you use the internet? Email? Have a smartphone? Fond of knowing how to get someplace you've never been, keeping track of your plans and backing up your documents? If you answered "yes" to any of those questions, you likely use Alphabet's Google and its suite of services on a regular basis. Like some of the other most valuable tech companies in the world, Google has gotten into antitrust trouble for its dominance, and with a roughly 90% global share of the search market, it's not hard to imagine why. Its free Android mobile operating system is hard for handset companies to turn down and comes installed with a suite of Google apps and the Google search engine as the default preference. The company got a huge year-over-year bump last quarter as advertisers returned after a wildly uncertain 2020, and revenue jumped 62%.

2)Microsoft Corp. (MSFT)

Market value: $2.2 trillion

The world's largest software company, Microsoft has added an extra dimension to its business in the last decade: the cloud. Although Amazon's AWS has long held the crown as the world's most dominant cloud provider, a May report from the research firm IDC has Microsoft's Azure tied with AWS for the biggest market share in public cloud services at 12.8%. After growing earnings per share by more than 25% annually over the last five years, Microsoft should post annualized EPS growth of 15% over the next half-decade, according to analyst estimates. In a stark illustration of its enormous scale, Microsoft just raised its dividend by 10% and approved a $60 billion stock buyback program. That's less than 3% of MSFT's market value but more than the entire worth of Chipotle Mexican Grill Inc. (CMG).

1)Apple Inc. (AAPL)

Market value: $2.35 trillion

Apple was the first company to reach a $1 trillion valuation, and it's maintained its lead as the world's preeminent tech stock. The scale of the California-based smartphone giant is difficult to comprehend, but to put it in perspective, it's likely that revenue from Apple Airpods alone exceeds the revenue of Adobe Inc. (ADBE), a tech giant in its own right worth more than $300 billion. Apple's biggest cash cow is obviously the iPhone, the most successful tech gadget of all time. Last quarter alone, iPhone sales clocked in at $39.5 billion, and the release of the iPhone 13 – replete with improved battery life, a faster chip and an improved camera – will surely rake in tens of billions more. The growth of Apple's high-margin services segment, with revenue topping $17 billion in the last quarter, has helped keep Apple atop the list of most valuable tech stocks.

Hence the top 10 biggest tech companies in the world are:

- Apple Inc. (AAPL) Market value: $2.35 trillion

- Microsoft Corp. (MSFT) Market value: $2.2 trillion

- Alphabet Inc. (GOOG, GOOGLE) Market value: $1.85 trillion

- Amazon.com Inc. (AMZN) Market value: $1.7 trillion

- Facebook Inc. (FB) Market value: $1 trillion

- Taiwan Semiconductor Manufacturing Co. Ltd. (TSM) Market value: $595 billion

- Tencent Holdings Ltd. (TCEHY) Market value: $550 billion

- Nvidia Corp. (NVDA) Market value: $525 billion

- Samsung Electronics Co. Ltd. (005930.KS) Market value: $440 billion

- ASML Holding NV (ticker: ASML) Market value: $350 billion

- Apple Inc. (AAPL) Market value: $2.35 trillion

- Microsoft Corp. (MSFT) Market value: $2.2 trillion

- Alphabet Inc. (GOOG, GOOGLE) Market value: $1.85 trillion

- Amazon.com Inc. (AMZN) Market value: $1.7 trillion

- Facebook Inc. (FB) Market value: $1 trillion

- Taiwan Semiconductor Manufacturing Co. Ltd. (TSM) Market value: $595 billion

- Tencent Holdings Ltd. (TCEHY) Market value: $550 billion

- Nvidia Corp. (NVDA) Market value: $525 billion

- Samsung Electronics Co. Ltd. (005930.KS) Market value: $440 billion

- ASML Holding NV (ticker: ASML) Market value: $350 billion